I’m back with another KILLER case study for you!

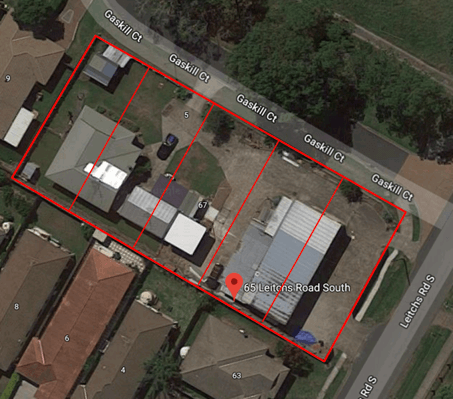

This time I’m featuring another student of mine, Peter Baumann, who made $496k in 12 months from a 1-into-5 subdivision in Albany Creek.

Peter had several interesting challenges with this project, which he explains in this video. I recommend you watch the video intently should you ever face similar issues 🙂

By the way, would you like to know the fastest, safest, easiest way (at least if you ask me…) to start doing deals with similar profits?

I show people how to do it ALL THE TIME.

And if you want to learn too, now you can for a FRACTION of what people usually pay to spend a full day with me.

Check out my full-day Subdivision Secrets Seminar and get everything you need to know!

Click Here And Save Your Seat (Early Bird discount expires soon!)

Here’s Peter’s case study

- 1 Into 5 Subdivision – including all important financial figures!

- The CRITICAL difference between “feaso looks great on paper” and “project puts money in the bank” (use this to AVOID NASTY DUDS!)

- How Peter got a $140,000 discount asking one SIMPLE question!

ORIGINAL Budgeted Numbers

Cash out:

- Purchase Price $900,000

- Purchase Costs $39,000

- Demolition Costs $23,000

- Subdivision $263,000

- Fencing $2,000

- Hold Costs $34,000

- Selling Costs $56,000

Total Expenses – $1,317,000 (ORIGINAL Budgeted Numbers)

Cash in:

- Net Sale Proceeds $1,775,000 ($355,000 x 5 Lots)

- GST $67,000

Total – $1,842,000 (ORIGINAL Budgeted Numbers)

Expected Profit: $395,000

ROI = 31% COCR = 73%

Not bad for 12 months work… right?

But what if I told you ACTUAL PROFITS ended up being more than $100,000 bigger, because of a few simple moves Peter pulled??!

Watch his case study now for the full story:

P.S. If you want the fastest, safest, easiest way (at least if you ask me…) to start doing deals just like this one, come to my full-day Subdivision Secrets Seminar – I’ll show you everything you need to know!

Click Here To Learn More (Early Bird discount expires soon!)